At Fountainhead Commercial, we believe in the adage, “Work hard, then play hard.” Of course, we’re meticulous when learning about our clients’ needs and then taking all necessary steps to achieve their best possible commercial real estate outcomes. But we’re also passionate about enjoying the great outdoor recreational opportunities colorful Colorado and the southwest have to offer.

When the work/play worlds intersect, life is good, like when we go fly fishing or golfing (that would be Lowrey) or mountain biking or hiking 14ers (that would be Justin) with a prospect or client. After all, you don’t really get to know a person over coffee or lunch or at a networking event. Those interactions have a vital role, but we’ve found that shared recreational experiences can add building blocks to an enduring business relationship foundation.

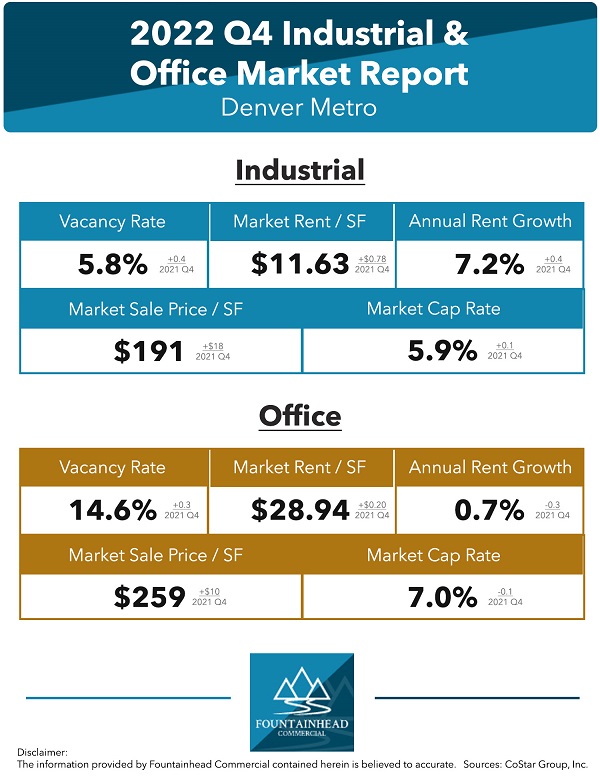

At first glance some of the 2023 Q1 data presented here seems contradictory: increased sales prices accompanied by declines in rent growth; higher vacancy rates alongside higher rent rates.

But if you look deeper into the data and consider the stories behind the numbers (which we’ll lay out below), there’s a logical explanation for the unique dynamics we’re seeing today in the Metro Denver commercial real estate (CRE) market.

Tenants and lessees often consider lease renewals to be perfunctory and routine. They may not be aware how the renewal process can give landlords the upper hand in setting terms of this new contract.

In fact, as soon as lessee signs the original contract, future negotiating leverage shifts to the landlord. Landlords knows that unless the lessee outgrows the space or has another strong reason to relocate at the end of that lease, they’ll gravitate toward re-signing and staying in that leased space. Landlords understand that businesses owners value continuity, and relocating is costly, disruptive to their business, and distracting for their employees.

Upscale, hands-on axe throwing entertainment has arrived in the Denver Metro area! When you get a chance, check out Yukon Axe in Westminster for a memorable social or team building outing.

Upscale, hands-on axe throwing entertainment has arrived in the Denver Metro area! When you get a chance, check out Yukon Axe in Westminster for a memorable social or team building outing.

The most recent commercial real estate (CRE) data show that we’re in a period of slow but steady transition. Throughout the Denver Metro area, the demand for industrial space has slowed and we’re likely in early stage of emerging from the depths of a depressed office real estate market.

We’re not out of the woods, yet though. Fed action is at least partially responsible for a dramatic decline in 12-month sales volume, which decreased almost 25.75 percent for industrial properties and 21.5 percent for office properties compared to Q3 2022. The CRE market is clearly in a wait-and-see mode at this time as it relates to future Fed interest rate increases.

In spite of the Fed’s rate increases and a slowly deteriorating economy, commercial real estate (CRE) transactions are still happening. But in a few cases, we’re seeing and hearing about transactions that seemed on track for closing just three or four months ago that are starting to fall apart.

720.837.9407

Denver, CO