Through a channel partner, we were referred to the Australian financial services company, Finstro, as they were reaching out into the U.S. to provide their innovative customer payments solutions. The company needed to establish a staffed, physical presence in the Denver region within three months to fulfill commitments they had made to their U.S. banking partner.

Finstro needed approximately 5,500 square feet of space, including 20% conference/huddle rooms, several executive offices, and shared space for their sales team.

It was a privilege to educate the Finstro team about the Denver region’s commercial real estate market, including what items are negotiable, what concessions to press for, the various lease structures, and even the differences in vernacular. We helped these company executives understand their options so they could make the best choice for their company and be in a strong position to explain and validate their decision to their shareholders.

The team knew enough about Denver to know they wanted to be in the downtown area with access to clients and to recruit the caliber of employees they wanted. The executives came to Denver twice for half-day site visits over a two-week period. In that limited time , we did an extensive review of properties on both ends of downtown (from LoDo to the Northeast side) and all points in between. We also presented the differences between Class C, Class B, and Class A properties.

The price points, access to employee transportation, and the availability of the necessary spec suites led us ultimately to 1660 Lincoln, a Class B+ property that ideally suited their needs, budget, and brand. We reviewed with the property manager the recent HVAC and other improvements they had made to the property.

Summary

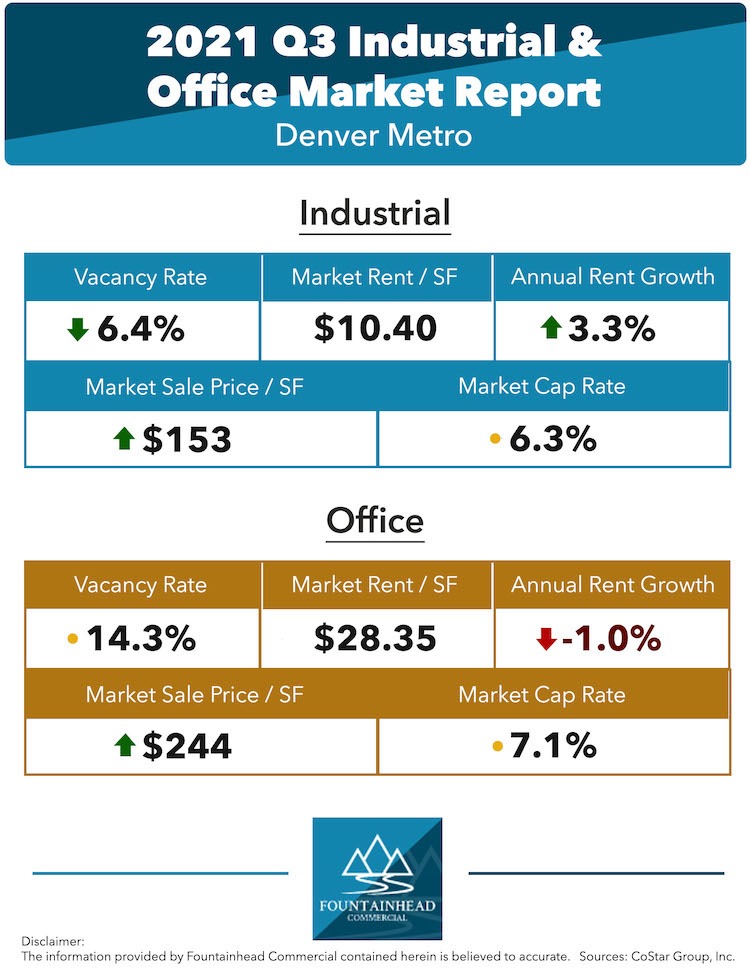

Reviewing the current marketplace for commercial property in the Greater Denver region is a tale of two sectors. The data for each of the two primary segments, industrial and office, matches the narrative we’re all familiar with regarding the relative impact of the COVID pandemic on these two market segments and the status of the financial recovery in each.

For most companies, it’s challenging to find a suitable office location. The available spaces can be too small, too expensive, or too far away for your needs. And sadly, only a few tenants receive the representation they need to not only save time but to save money too. Office tenant representation can help you worry less about finding a suitable space and instead focus more on the daily operations of your business so things continue to run smoothly.

What kind of commercial real estate brokerage firm do you want to represent your interests? Like many organizations, the leadership can heavily dictate or influence the approach to client interaction and conducting business. Perhaps you're seeking a company whose public image and actions are polished, highly ‘corporate’ transactional values that often lack a personal, client-first feel. Or maybe you prefer a company that treats you like you’re their only client and places high value on building and maintaining long-term relationships with those they represent. There is no ‘right’ methodology because different styles can find alignment with different client personalities. As my grandfather often said, “There is a butt for every chair”. Looking beyond demeanor and approach, top commercial real estate companies in Denver will provide the following as part of their day-to-day service offering:

If your business owns and occupies its commercial real estate, you already know how challenging it can be to find a space that suits your needs. Finding the perfect space—whether it’s office, industrial, or retail—is rarely ever easy, especially when markets are experiencing low vacancies, rising property prices, and increasing construction costs. A sale-leaseback is an attractive financial arrangement for many business owners who want to maximize the value of their commercial real estate, raise capital, and reduce (or altogether eliminate) debt. And while the sale-leaseback process might seem simple on the surface, it's actually quite complex.

Making money outside of your day job is a great way to boost your net worth, reach your financial goals, and fund your future retirement. But navigating the world of commercial real estate investments isn't easy. So before you jump in feet first, there are a few things you need to know ahead of time. Today, we're breaking down the best ways to generate passive real estate income and how to avoid common (and costly) mistakes.

720.837.9407

Denver, CO