We’ve all heard the headlines: "Downtown offices are dead," or "Cities rush to turn towers into apartments." Sounds dramatic, right? But let’s pause the media noise for a minute and take a closer look—especially at what this actually means for business owners and property decision-makers here in Denver.

The post-2020 workplace continues to undergo significant transformation, with some younger employees hesitant to return to traditional office environments.

The commercial real estate office landscape in the Denver metro area continues to evolve in response to shifting economic & political conditions, industry trends, and emerging demands from businesses. Navigating through these conditions can feel like a maze, especially if you’re a business owner trying to balance growth, operational needs, and the challenges of owning of leasing office space.

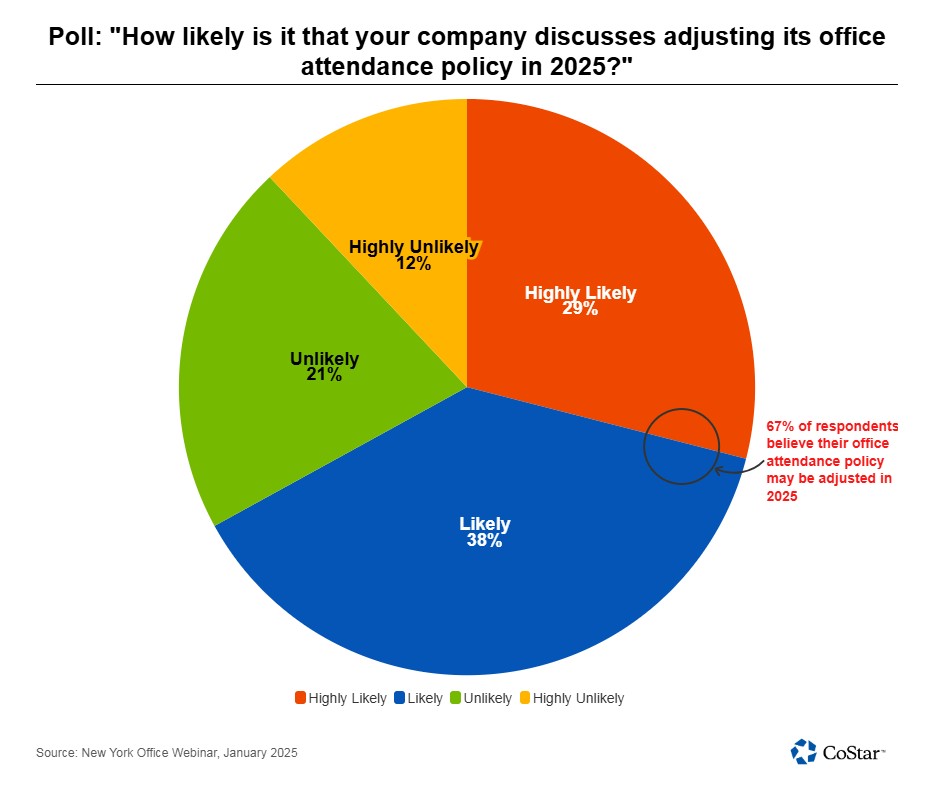

As we step into 2025, one of the most notable shifts in the workplace may revolve around Return To Office (RTO) attendance policies. According to a recent poll conducted during a CoStar New York office webinar, a significant portion of employees anticipates changes to their office attendance requirements in the new year. This shift follows broader trends in the corporate world, with many companies revisiting their stance on remote and hybrid work arrangements.

When investing in commercial real estate (CRE), understanding the different types of leases is critical. Each lease structure offers varying degrees of responsibility and risk, which can affect your returns—especially if you're utilizing a 1031 Exchange to defer capital gains taxes. Below, I’ll walk you through the most common lease types: Absolute NNN, NNN, Modified Gross, and Full-Service Gross—and how each one fits (or doesn’t) into a smart 1031 Exchange strategy.

What Office and Industrial Tenants Need to Know About Foreclosures and The Impact on Your Business.