These days, spoken or unspoken “Thank Yous” are more important than ever. There are plenty of things in our world and in our lives that can make us feel worried or even angry. Those thoughts need to be balanced with genuine acknowledgements of the good in our lives – both people and situations.

Recently released Q3 2023 Metro Denver commercial real estate (CRE) data confirms the situation on the ground we’ve been observing. The market is bifurcated. The office market is struggling; the industrial market is still relatively robust. The single-tenant retail market is also strong. CRE activity continues to move from Denver’s downtown core to suburban areas.

For some struggling companies, there may be a lease renegotiation strategy that can help alleviate the financial stress their leased office space is creating. In many cases, these challenged businesses are weighed down with the burden and cost of unused office space, whether it’s because they’ve let people go, they’ve had to accommodate their employees’ desire for hybrid or work-from-home arrangements, or they’ve had employees quit due to a back-to-office mandate. As these business leaders consider their options, they should realize that their landlords also are feeling pain in this economy … and this opens the door to a solution that can help both parties make the best of their respective bad situations.

It seems many major employers are becoming less nervous about implementing adamant, wholesale return-to-the-office mandates.

Over the past 18 months, they’ve steadily progressed from inviting employees to come back, then encouraging/incentivizing them, and then requiring their attendance, albeit with a seeming lack of enforcement. The next step, one that we’re seeing now, is enforcing those requirements that many employees have simply ignored.

Offices are slowly filling up. A recent study documented that during the pandemic, 55% of workers who could do their jobs from home did exactly that. Now, 41% are working hybrid and only 32% are still working full-time from home.

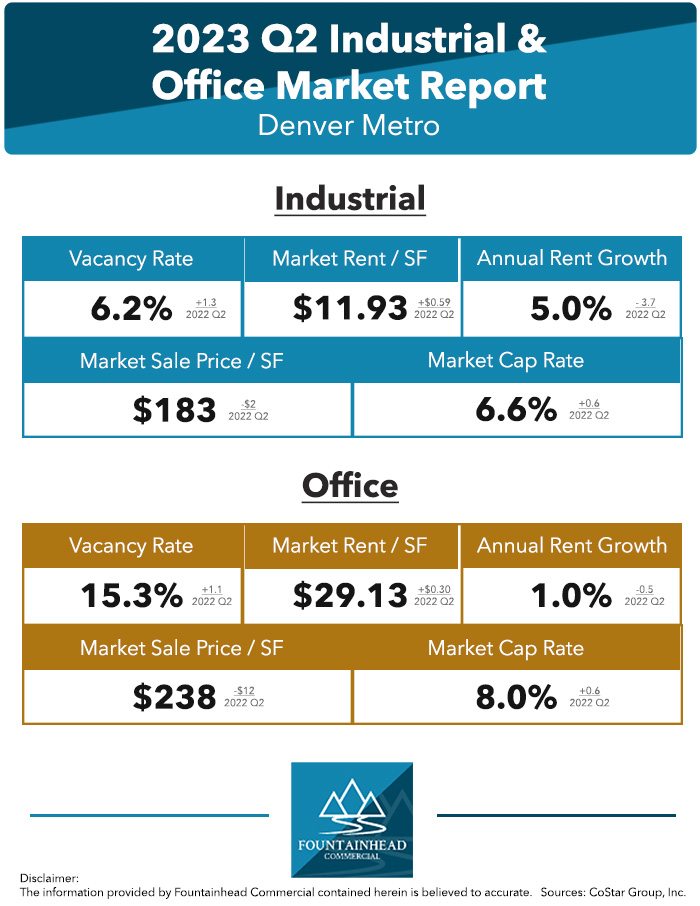

The Q2 2023 Metro Denver commercial real estate (CRE) data shows that the industrial and office markets are both softening. The turning point is very recent on the industrial side, but the decline in the office market segment represents the continuation of a multi-year trend.

“Give a man a fish, and you will feed him for a day. Teach a man to fish and you feed him for a lifetime.”

We’ve all heard this adage before in one form or another, and its origin is somewhat fuzzy. But the principle comes through loud and clear. The best way to help our fellow man is to give them the tools to be successful. For our team at Fountainhead Commercial, that principle guides how we support our clients as well as our community.

We don’t take credit for our clients’ business success, and we can’t make them successful. Our role is to place them in the right physical environment with the best terms so they can put all their focus into successfully operating and growing their businesses. We literally place them in a position to succeed.

720.837.9407

Denver, CO